Institutional-caliber, longevity-based investing strategy that seeks to diversify and amplify returns.

AAJAX (A Shares)

AAJIX (I Shares)

Daily Nav

$0.00

Inception Date

00/00/2022

Ticker

AAJIX

Daily YTD Return

0.00%

Total Net Assets

$0.00

Inception (Annualized)

0.00%

Alpha Alternative Assets Fund

The Alpha Alternative Assets Fund’s (the “Fund”) investment objective is to generate current income and long-term capital appreciation. The Fund seeks to achieve its investment objective by investing primarily in “longevity-based assets.” Longevity-based assets include financial instruments across a range of asset types, qualities, and sectors that produce returns contingent upon (i) the continued aging of the U.S. and global population, and (ii) individual life expectancies within the 70+ age cohort.

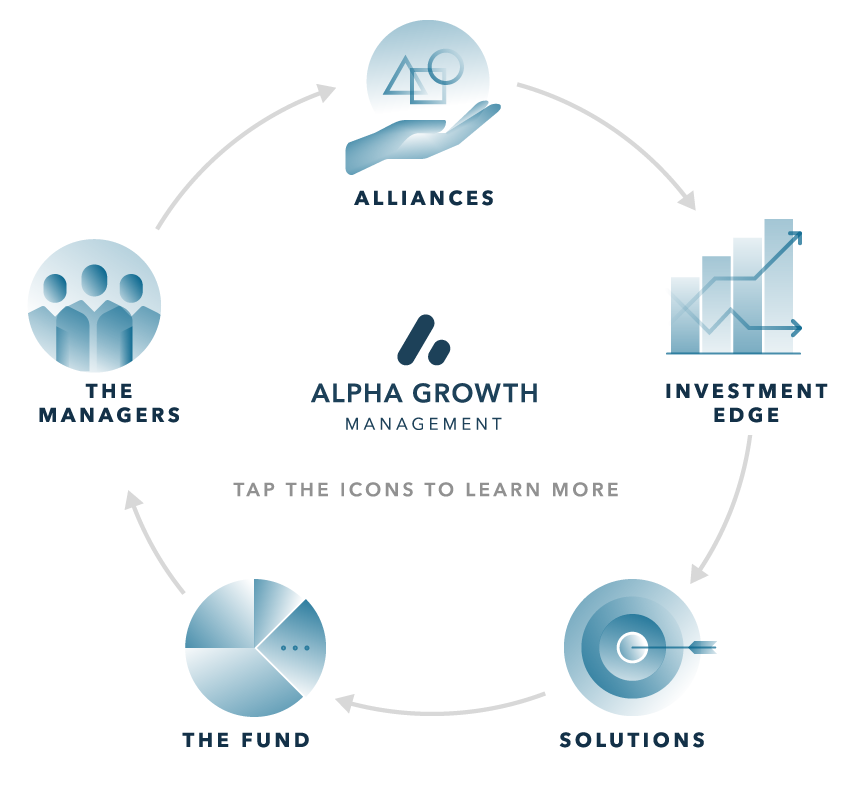

Solid credentials. Deep alliances.

Liquidity with enhanced return potential.

Institutional approach. Low barrier to entry.

- Quarterly Distributions targeting 5%

- Capital Appreciation targeting an additional 4-6%

- Daily Pricing and Periodic Liquidity

- Experienced team with concentrated expertise in alternative investments and portfolio management

- Active Management of multiple fund “Sleeves” through the Adviser and Sub-Adviser

- Carefully selected managers for acquired funds

- Best-in-class actuarial advice and transparent valuation policies

- Liquid and Illiquid “Sleeve” of Portfolio

- Liquid sleeve mitigates drag of uninvested cash while aiding portfolio liquidity

- Illiquid sleeve allows for potential enhanced returns of long-term products

- Institutional investment access with low minimums

- Emphasis on low correlation to traditional Equity/Debt markets

- Diversified approach built to withstand volatile market cycles

Overview

The Fund seeks to achieve its investment objective by investing primarily in “longevity-based assets.” Longevity-based assets include financial instruments across a range of asset types, qualities, and sectors that produce returns contingent upon (i) the continued aging of the U.S. and global population, and (ii) individual life expectancies within the 70+ age cohort.

Investment Strategy

The Fund seeks to achieve its investment objective by investing primarily in “longevity-based assets.” Longevity-based assets include financial instruments across a range of asset types, qualities, and sectors that produce returns contingent upon (i) the continued aging of the U.S. and global population, and (ii) individual life expectancies within the 70+ age cohort.

Specifically, longevity-based assets consist of debt securities, including whole loans and securitizations of life settlements, annuities, and pharmaceutical and medical patent royalties; preferred and common equity securities that provide exposure to longevity-based industries and sectors such as life insurance; debt and surplus notes of life insurance companies; and real estate based assets including reverse mortgages and tax liens (lending products used by homeowners as they age), real estate lending secured by senior housing, assisted living facilities, hospitals and other geriatric specific healthcare facilities.

Manager’s Expertise

The principal elements of the Investment Manager’s investment process include: (i) opportunity identification and analysis; (ii) portfolio construction; (iii) liquidity management; and (iv) investment monitoring. The team relies on expertise in the following areas:

Actuarial Science

- Life-Contingent Analysis

- Aging Population Trends

- Actuarial Analysis

- Life Insurance Underwriting

Securities Analysis

- Loan Underwriting

- Public Debt & Equity Analysis • Private Investment Analysis

- Securitization Analysis

| Fund Terms | |

|---|---|

| Structure | 1940 Act Fund, Continuously Offered, Closed-End |

| NAV | Daily |

| Liquidity | Quarterly Repurchase Offers of Minimum 5% |

| Adviser | Alpha Growth Management |

| Sub-Adviser | Haven Asset Management |

| Administrator | ALPS Fund Services, Inc. |

| Transfer Agent | DST Systems, Inc. |

| Distributor | ALPS Distributors, Inc. |

| Custodian | UMB |

| Sales Load | A Share: Maximum 5.75% I Share: No Load |

| Management Fee | 1.50% |

Performance

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

Total Net Return

Portfolio

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

About the Managers

Alpha Growth Management Inc (“AGM”), a wholly-owed subsidiary of Alpha Growth PLC, serves as the Fund’s Investment Manager. AGM specializes in alternative investment strategies in Insurance and Longevity Assets. While overseeing and monitoring all investment activity of the Fund, AGM is directly responsible for the management of the “Illiquid” sleeve of the Fund.

Alpha Growth PLC is a London Stock Exchange listed company specializing in longevity asset management. Through its subsidiaries and operating companies, Alpha Growth PLC currently has over $350 million of assets under management.

Haven Asset Management (Interval Funds) LLC serves as the Fund’s Sub-Adviser, providing expertise and portfolio management services to the “Liquid” sleeve of the Fund. Haven’s portfolio managers bring over 20 years in fixed-income management and over $5 billion in assets under management.

He has performed at senior executive level within multiple organisations that specialise in distressed debt and discounted assets totalling in excess of $750m across North America, Europe and the UK. Additionally, Gobind was the Chairman of Stratmin Global Resources plc. His involvement began with its investment and turnaround which consisted of £2 million in distressed assets. As Chairman, he organized and executed a turnaround through the liquidation of those assets and the identification and reverse takeover of a mining company and the associated multi-million pound fundraise.

He has spoken as a subject matter expert on distressed debt and discounted asset investing at ACA International conferences in the US, and at Credit Services Association conferences in the UK. Gobind is a graduate of Babson College, Wellesley, Massachusetts, and holds a Bachelors degree in accounting and finance. He also served on the board of trustees of Babson College from 2001 to 2010.

While at LDA, Danny was responsible for the closing of over $4 billion in life settlements. Danny spent the previous eight years working for American International Group (AIG) as Vice President. Responsibilities encompassed developing and executing marketing strategies for life/annuity products in the alternative distribution channels, this included product distribution through broker-dealers and third-party administrators in both the North American and international markets. Danny earned a Bachelor of Science degree in Marketing from California State University Northridge, and Master of Business Administration degree from Pepperdine University.

Since joining DRB in 2015, Mr. Sutherland has negotiated and structured multiple warehousing facilities of up to $600m. He also launched the first ever AAA rated placements of mortality backed linked annuity receivables totalling $151m. Mr. Sutherland recently ran $3bn of policies under the Lamington Road Fund in Dublin, Ireland which was acquired by Emergent Capital, ran Citadel’s London office at the same time, and was Managing Director of DLP funding group out of London under Peach Holdings LLC, with $1.5bn under management. Prior to that Mr. Sutherland spent 12 years with the Peach Holdings Group, most recently as Managing Director of Legal and operations for Peachtree Asset Management based in London and Luxembourg, a Global leader in uncorrelated investments for institutional clients, where he obtained FCA approval, guiding the fundraising efforts, and coordinating with regulatory bodies in UK, US, Cayman Islands, Luxembourg and Ireland. Mr. Sutherland received his Juris Doctorate in Boston in 1999 and was subsequently admitted to the State Bar of Georgia. Mr. Sutherland is also a member of the New York Bar, United States Supreme Court, Georgia Supreme Court among others, and maintains an FCA CF1, CF3, CF10 and CF11.

Important Disclosure Information

This is neither an offer to sell nor a solicitation to purchase any security. Investors should carefully consider the investment objectives, risks, charges, and expenses of the Alpha Alternative Assets Fund (the “Fund”).

Past performance is not a guarantee of future results. Investing in the Fund involves risks, including the risk that you may receive little or no return on your investment or that you may lose part or all of your investment.

This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product or be relied upon for nay other purpose.